It's no secret that the recent gains in the stock market have been concentrated in the A.I. sector. It's been something like the Dotcom Bubble, though not anywhere to that extent. Lots of enthusiasm and hype, high valuations, and mixed results when it comes to actual earnings.

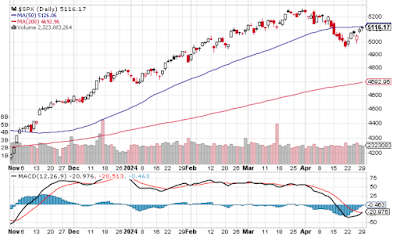

The S&P 500 is top-heavy with A.I. stocks, hence its performance this year:

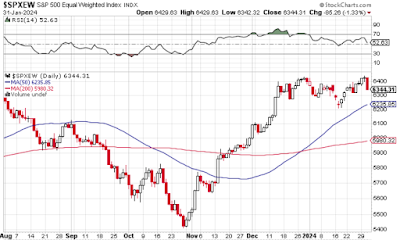

When we equally weigh the components, removing a little bit of the A.I. bias, we get results that, while still bullish, are a little more modest:

When we look only at small-cap stocks, completely removing heavy-hitting companies like Nvidia, Microsoft, Amazon, Google, and so on and so forth, we get results that are a bit more concerning:

The Russell 2000 index is about where it was at in late December. It's gone sideways for this calendar year so far. Whatever "bullishness" exists in the stock market, it seems to be a phenomenon of the large caps, not the small ones. The A.I. boom has not trickled down to the little guys. When you factor in inflation, the small caps are actually down slightly.

I've made this comparison between these three indexes in previous blog posts, but it's always good to revisit it every now and then to see if the prevailing patterns are still holding. And that seems to be the case. The "bull market" is an A.I. bandwagon ride, nothing more.

Now, Memorial Day weekend has just passed us by, so summer has now officially begun, which means travel season is here. Maybe we'll see something interesting in the vacation-related economy. I don't know.

There's a Federal Reserve board meeting in the middle of June. Lots of people have been expecting an interest rate cut at that meeting. I'm a bit more skeptical. I'm not sure if a rate cut is priced into the market or not, though. The Fed might remain hawkish on inflation, but the market might not be bothered by it much at all. We'll just have to see.

Oil and gold have risen in recent months, but not as much as I would have expected given the geopolitical realities. My portfolio is still oil-heavy, though. As long as there's a "war on oil" in this country, I expect non-American oil companies to benefit. The modern world runs on oil whether people like it or not.

What does the summer hold? Well, I don't know. Summer is usually a dead season for stocks, though there has been the occasional bull-market summer before. I'm inclined to say the action will be mostly sideways until evidence to the contrary presents itself.

BRICS summit in October in Russia. If there's going to be any major global economic news, I expect it to happen then. That at least gives us the whole summer to chill out, though, so that's what I intend to do. I recommend everyone else to stay cool, too. There will be plenty of things to panic about in the fall.