I think I'm ready to start sending out my newsletter in Substack. TinyLetter is going away, so I had to find a replacement, and I decided to go with Substack. There will be some cosmetic differences in the emails, but hopefully there won't be any real snags.

SpaceX is heading for the moon. On the one hand, I'm not a fan of moon missions because I think it's just a useless rock with no real promise, but on the other hand, it's still a really cool thing to do. I even picked up some shares of Intuitive Machines as a result of the successful launch and in the hopes of a successful landing and mission. Which brings me to my next point...

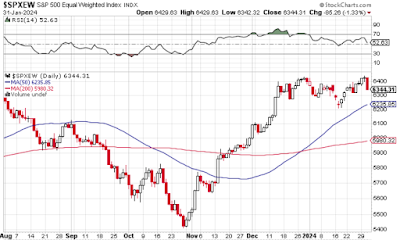

I bought shares of a couple of stocks on Thursday. I did this in spite of the fact that I think markets are overbought and in need of a correction. My gut tells me that this purchase of mine can be considered a contrarian indicator; in other words, my finally giving in is what will signal the start of the decline. Will we see a correction within the next few weeks? I think the odds of it just got significantly better.

As part of the moon mission, the Columbia apparel company is using its Omni-Heat Infinity technology to shield the craft from the extreme temperatures of space. Here's a YouTube video about it:

I like and sometimes wear Columbia's stuff, and I think this promotional venture of theirs, while admittedly a bit gimmicky, is nonetheless pretty darn cool. By modern marketing standards--by which I mean we live in an era in which corporate marketing departments seem to be purposefully trying to destroy their brands--it's downright genius. After I publish this blog post, I'm going to go over to Yahoo Finance and take a look at Columbia's stock info.

I've started gaining weight again. I'm about ten pounds heavier than where I'd like to be. I'll try to reduce that in the weeks ahead. My overall fitness level is really quite pathetic.

I finished The Hour of the Dragon, the only novel-length Conan story by Robert Howard. It was a serviceable enough book. I could have done without the "he ejaculated" dialog tags and other goofy devices, but it was still a Conan story, so it still had all the awesome stuff for which such stories are famous.