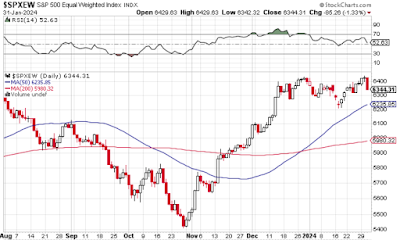

This stock market continues to defy my attempts to figure it out. Since early November, it's been practically a straight line going up at about 25 degrees above horizontal. I've never seen a cleaner bull market trend line. Frankly, it's too perfect, and I can't help but wonder how much of it is the result of human activity and how much is just bots and algorithms making automated trades.

Gold continues to hit new highs. It's been doing this for the past few weeks. The price of everything seems to be climbing at a disturbing and unsustainable rate, so naturally the powers that be say that inflation is under control. (That was sarcasm in case you weren't sure. Inflation is actually quite onerous, and lots of people are suffering because they can't afford anything.)

I own several South American stocks, so I'm now keeping on eye on the political squabbling that has erupted on that continent recently. The embassy raid in Ecuador is just the latest in a series of dust-ups. In all the talk of a potential World War III that's been going on lately, commentators usually focus on Russia, Ukraine, NATO, and the Middle East. No one is talking about WWIII breaking out in South America, and that makes my inner contrarian think that's where it might start.

Stock market crashes often happen in September and October, but if I recall correctly, April and May are the next best months for it to happen. If we can make it to June without a crash or correction, then maybe we can have a soft-landing consolidation or something during the summer.

In the meantime, though, the bull market seems unstoppable. I'm not selling out. I'm keeping my positions, collecting my dividends, and waiting for the wave to crest.

But crest it must, eventually, and woe to those who get caught in the undertow.