The Federal Reserve left rates unchanged, and that's no surprise. The question everyone is trying to figure out is when they'll start cutting. From what I can tell, no one is considering the possibility of zero rate cuts in 2024, and the notion of a rate increase is basically unthinkable. The market has priced in rate cuts, and any news that shakes that faith should have a bearish effect on stocks.

Meanwhile, the S&P 500 has charged ahead to new highs this year.

The chart is just a bit misleading, though. The S&P 500 is heavily weighted towards the Magnificent 7 stocks. Most of the gains have come from those stocks: Microsoft, Alphabet, Amazon, Apple, Meta, Nvidia, and Tesla. A significant part of those companies' gains are undoubtedly due to the A.I. craze of last year.

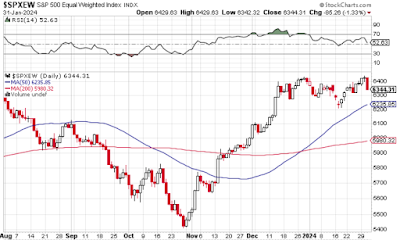

So, those companies aside, what does the market look like in general? For that, we look at the "equal weight" chart of the S&P 500. In this one, all of the components of the index are given equal weight. Here it is:

As you can see, no new highs in 2024 for the equal-weight version.

In fact, the lack of gains is even more apparent when you broaden the timeline out to five years. Here's the normal (unequally weighted) chart for the index:

And here's the equal-weight version over the same time period:

In this second chart, the market peaked in January of 2022 and has yet to revisit that high. Take out the bias towards the Magnificent 7, and stocks have basically gone sideways for two years.

I thought in December that we'd see a correction in the first quarter of this year, and I still think that. So far, though, all the would-be catalysts for market declines have amounted to nought. Red Sea traffic disruptions, Middle East conflicts, Russo-Ukrainian stuff, farmer protests in Europe, all of the myriad American domestic issues... none have succeeded in spooking the market. It seems highly irrational to me, but, as the saying goes, markets can remain irrational longer than you can remain solvent.

Just FYI, though... the VIX is about where it was in late 2019/early 2020. I expected a correction then, too, and we got an outright crash in February/March of 2020 as a result of the Covid panic. Here's the five-year chart of the VIX with the 2020 spike readily apparent:

The starter gun is cocked. All we need is some event to pull the trigger.

We'll see what February brings us.

No comments:

Post a Comment