The recent Fed meeting resulted in no rate increase. I was actually kind of surprised by that. I thought Jay Powell was going to keep raising rates and was simply playing it coy in the meantime.

The Fed also said it might raise rates later this year, so it's presumably not yet finished fighting inflation.

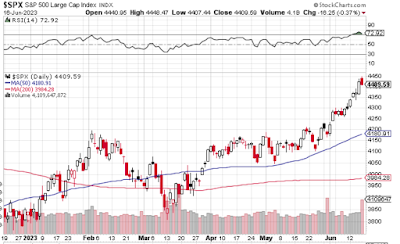

The stock market reacted with a strongly bullish next-day trading session. Friday's action saw a modest pullback.

So where do we go from here?

I'm not sure, so when in doubt, examine the price action. Let's see what the chart tells us.

The most recent candles have gone parabolic. Not only that, but RSI is clearly in "overbought" territory. And the VIX is at the lowest level it's been since before Covid. All these factors together suggest the stock market is ripe for a pullback.

That doesn't mean a bear market is imminent. It just means a consolidation is in order. We saw similar technical indicators in the summer of 2020. On two different occasions, the bull market became parabolic and the RSI indicated it was overbought. On both occasions, the market pulled back for a while. After a few weeks of consolidation, it continued up. The lull in the bull run was just that: a lull, not an end.

So I'm expecting something similar this time: some whipsaw action for a few weeks. Then I think it will continue up, at least for a little while.

Remember that there was a bull market for most of 2007 in spite of all the warning signs in the real estate and mortgage/finance industries. Stocks peaked that year in October.

In the meantime, global de-dollarization continues. Last I read, some African nations were jumping on the BRICS/yuan bandwagon.

And, of course, there's this whole Ukraine business. War is the ultimate x-factor.

Exciting times ahead, I fear. Prepare accordingly.